44 are zero coupon bonds taxable

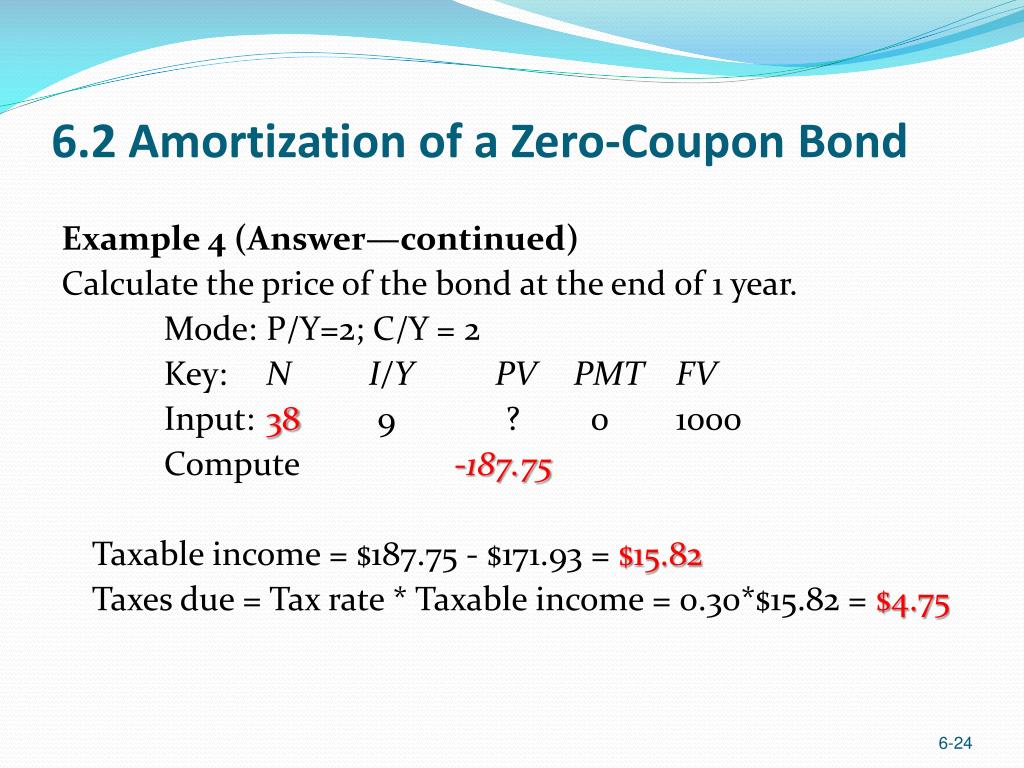

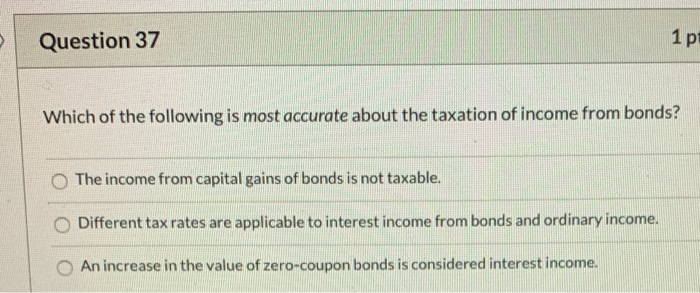

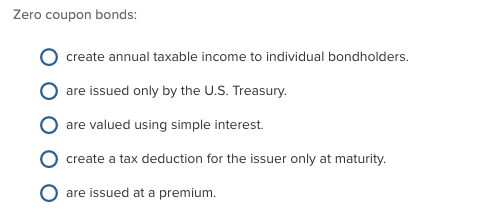

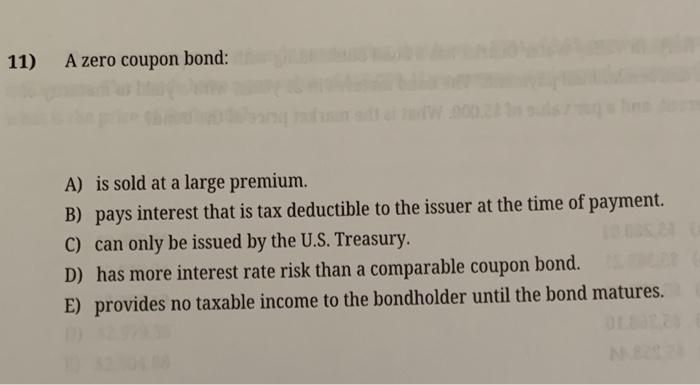

The One-Minute Guide to Zero Coupon Bonds | FINRA.org One last thing you should know about zero-coupon bonds is the way they are taxed. The difference between the discounted amount you pay for a zero-coupon bond and the face amount you later receive is known as "imputed interest." This is interest that the IRS considers to have been paid, even if you haven't actually received it. Tax Considerations for Zero Coupon Bonds - m.finweb.com Tax Considerations. Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond.

Are zero coupon bonds taxable

TAXABILITY OF ZERO COUPON BONDS - thetaxtalk.com Zero coupon bonds are taxable under two heads depending upon how the bond is held. If the bonds are held as capital asset, these are taxable under the head "Income from Capital Gains". These can be short term or long term depending upon the holding period. i.e. 12 months. Long term Capital gains will be taxable at the rate of 10%+ cess. No › publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The debt instrument is a stripped bond or coupon (including zero coupon bonds backed by U.S. Treasury securities). The debt instrument is a contingent payment or inflation-indexed debt instrument. See the discussions under Figuring OID on Long-Term Debt Instruments or Figuring OID on Stripped Bonds and Coupons , later, for the specific ... How is tax calculated on a zero coupon bond? - Quora So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not. It is often called "phantom" interest, for this reason; and is often the reason people relegate zeros to their IRA, if at all possible. Sponsored by Grammarly

Are zero coupon bonds taxable. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom Taxation of Zero coupon bonds | P2P Independent Forum Post by phil onMar 7, 2017 at 7:08am. Zero coupon bonds or any debt issued at a deep discount (those issued at 0.5%pa+ discount to maturity value) are generally taxed as income at maturity. There are a few exceptions to this treatment eg for life insurance policies, but none would seem to apply in this case. Tax Considerations for Zero Coupon Bonds - Financial Web Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between. Education investing--When you are investing to pay for a child's education, you could put the bond in his or her name.

Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. What is the tax implication on zero coupon bonds? Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of c... Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia The downside of zero-coupon bonds is that they may not offer the investor as many benefits, such as a higher return on investment and tax benefits. These types of bonds also have a higher risk because there is no income over their useful life. The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes.

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club Income arising from zero coupon bonds as defined in Section (48) (2) shall be taxed only in the year in which same is transferred or redeemed or matured. Tax liability of investor on transfer of zero coupon bonds may be either short term or long depending upon the holding period, i.e. for not more than 12 months or otherwise. Do you pay taxes on zero coupon bonds? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket. › money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

How is tax calculated on a zero coupon bond? - Quora So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not. It is often called "phantom" interest, for this reason; and is often the reason people relegate zeros to their IRA, if at all possible. Sponsored by Grammarly

› publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The debt instrument is a stripped bond or coupon (including zero coupon bonds backed by U.S. Treasury securities). The debt instrument is a contingent payment or inflation-indexed debt instrument. See the discussions under Figuring OID on Long-Term Debt Instruments or Figuring OID on Stripped Bonds and Coupons , later, for the specific ...

TAXABILITY OF ZERO COUPON BONDS - thetaxtalk.com Zero coupon bonds are taxable under two heads depending upon how the bond is held. If the bonds are held as capital asset, these are taxable under the head "Income from Capital Gains". These can be short term or long term depending upon the holding period. i.e. 12 months. Long term Capital gains will be taxable at the rate of 10%+ cess. No

Post a Comment for "44 are zero coupon bonds taxable"