42 formula for coupon payment

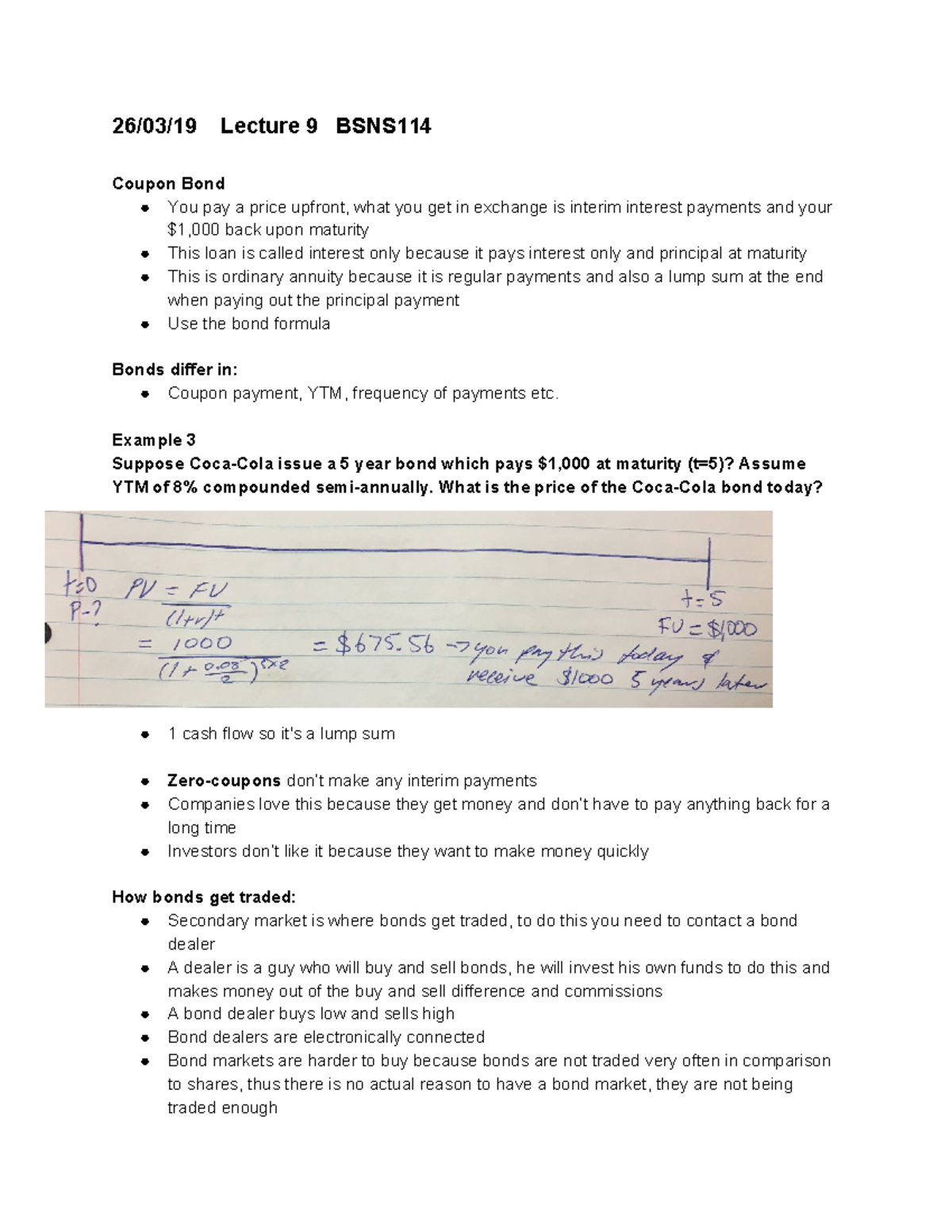

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate.

› coupon-bond-formulaCoupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ...

Formula for coupon payment

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. ... › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × ... Loan Payment Formula (with Calculator) - finance formulas Alternative Loan Payment Formula. The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

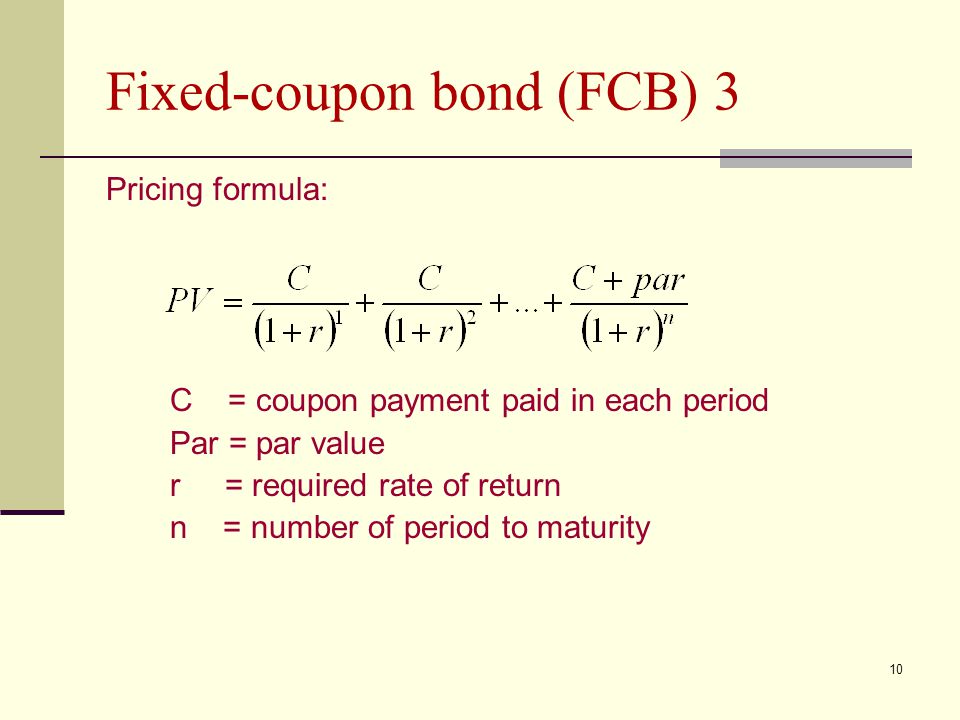

Formula for coupon payment. Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ... › amazon-couponsAmazon Coupon Codes: October 2022 Promo Codes - Dealcatcher.com Oct 16, 2022 · Snag this Casual Long Sleeve Hoodies for 70% off after using Amazon coupon code and clipping the coupon found on the product page. Spend $25 or more to qualify for free shipping or use your Amazon Prime account for free shipping. Expires 10/19/22 Pricing bonds with different cash flows and compounding frequencies Semiannual coupon payments. Many bonds pay coupon interest semiannually. When bonds make semiannual payments, 3 adjustments to Equation 1 are necessary: (1) the number of periods is doubled; (2) the annual coupon rate is halved; (3) the annual discount rate is halved. ... then we can express the general formula for valuing a bond as follows: C ... Calculate the Value of a Coupon Paying Bond - Finance Train Par Value = $1,000. Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60. Maturity = 1 year. The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually. The general bond pricing formula for all bonds can be ...

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. › Gerber-Good-Start-Non-GMO-FormulaGerber Good Start Baby Formula Powder, SoothePro Comforting ... Apr 01, 2019 · Gerber Good Start Baby Formula Powder, Gentle Soy, Plant Based Protein & Lactose Free Non-GMO Powder Infant Formula, Stage 1, 20 Ounce (Pack of 1) 4.7 out of 5 stars 1,600 1 offer from $38.99 Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

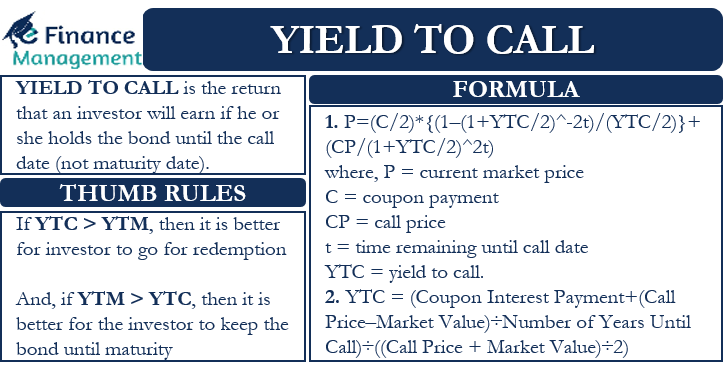

› bond-pricing-formulaBond Pricing Formula |How to Calculate Bond Price? - EDUCBA Coupon Rate (C) – This is the periodic payment, usually half-yearly or yearly, given to the purchaser of the bonds as interest payments for purchasing the bonds from the issuer. The bond prices are then calculated using the concept of Time Value of Money wherein each coupon payment and subsequently, the principal payment is discounted to ... COUPDAYS Function - Formula, Examples, How to Use The COUPDAYS function helps in calculating the number of days between a coupon period's beginning and settlement date. Formula =COUPDAYS (settlement, maturity, frequency, [basis]) The COUPDAYS function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security. › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link › current-yield-formulaCurrent Yield Formula | Calculator (Examples with Excel Template) Annual Coupon Payment = 7% * $1,000; Annual Coupon Payment = $70; For Bond 2. Annual Coupon Payment = 8% * $1,000; Annual Coupon Payment = $80; Current Yield of a Bond can be calculated using the formula given below. Current Yield = Annual Coupon Payment / Current Market Price of Bond

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples)

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to use the Excel COUPNUM function | Exceljet Number of coupons payable Syntax =COUPNUM (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Number of coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version

Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

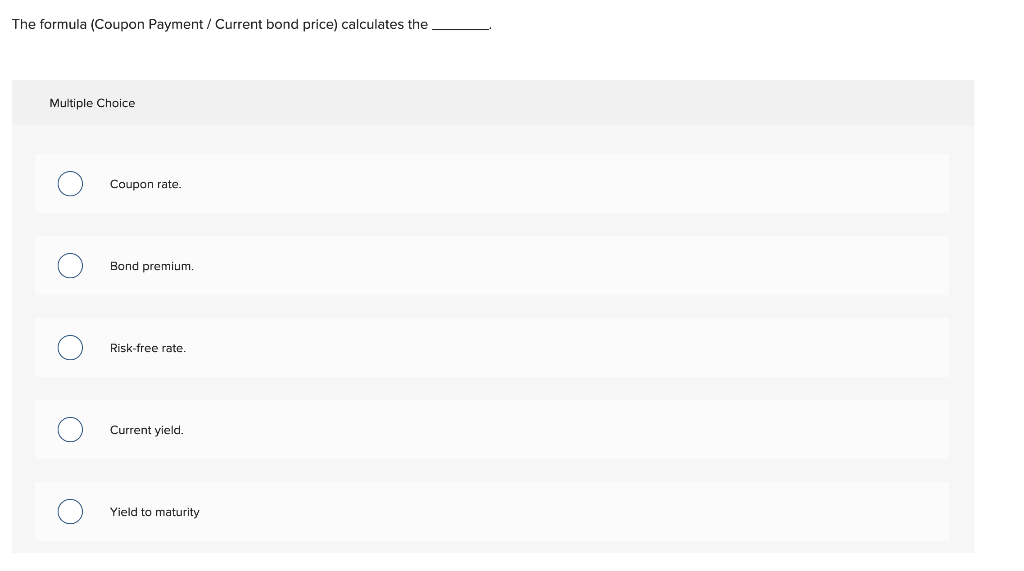

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p . where: ... It is important to be aware of the frequency of the interest payment when analyzing bonds. As a point of ...

What is a Coupon Payment? - Definition | Meaning | Example Despite the attractive return, he decides to purchase $10,000 of the US Treasury Bond. Now, how will this affect his $10,000 principal? Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

How to use the Excel COUPNCD function | Exceljet Syntax =COUPNCD (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Excel 2003 Usage notes

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity.

Coupon Payment | Definition, Formula, Calculator & Example Formula Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037.

How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as …

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Loan Payment Formula (with Calculator) - finance formulas Alternative Loan Payment Formula. The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. ... › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × ...

Post a Comment for "42 formula for coupon payment"