41 government zero coupon bonds

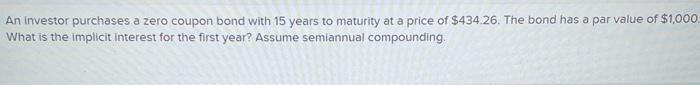

Zero-Coupon Bond: Formula and Excel Calculator U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. en.wikipedia.org › wiki › List_of_government_bondsList of government bonds - Wikipedia TEC10 OATs - floating rate bonds indexed on constant 10year maturity OAT yields; OATi - French inflation-indexed bonds; OAT€i - Eurozone inflation-indexed bonds; Agence France Trésor Germany. Issued By: German Finance Agency, the German Debt Agency Bunds. Unverzinsliche Schatzanweisungen (Bubills) - 6 and 12 month (zero coupon) Treasury ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond.

Government zero coupon bonds

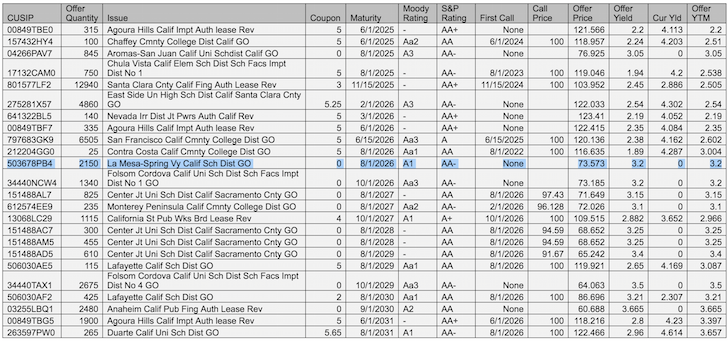

› country › united-kingdomUnited Kingdom Government Bonds - Yields Curve Jun 11, 2022 · The United Kingdom 10Y Government Bond has a 2.547% yield.. 10 Years vs 2 Years bond spread is 43.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). Government - Continued Treasury Zero Coupon Spot Rates* 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero Coupon) Rates" on ... Domestic bonds: USA, CMB 0% 11oct2022, USD (119D) US912796YD50 Issue Information Domestic bonds USA, CMB 0% 11oct2022, USD (119D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... The U.S. government bond market is the largest, most reliable and liquid in the world. ... Zero-coupon bonds CMB ...

Government zero coupon bonds. Further details about yields data | Bank of England Zero coupon real curves. Calculated from the prices of index-linked gilts, which were first issued following the 1981 budget, and comprised approximately 25% of the UK Government bond market at end-March 2001. › terms › zZero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... Govt's capital infusion via zero coupon bonds positive for PSU banks With the zero coupon bonds, the banks will not benefit from that income. Since FY18, the government has used recapitalisation bonds with banks subscribing to them with a maturity ranging between 10 and 15 years, and coupon rates of 7.4 per cent-7.7 per cent. The government would then use the funds raised to be infused back in PSBs as equity. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage account .

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... Statistical Tables | RBA Capital Market Yields - Government Bonds - Monthly - F2.1. Data. Aggregate Measures of Australian Corporate Bond Spreads and Yields - F3. ... Zero-coupon Interest Rates - Analytical Series - 2009 to Current - F17 . F17 - Discount Factors; F17 - Forward Rates; F17 - Yields; Yield from Government 10 bonds UK 2022 | Statista Published by Statista Research Department , May 2, 2022 The monthly average yield on 10 year nominal zero coupon British Government Securities in the United Kingdom (UK) has seen a continued... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

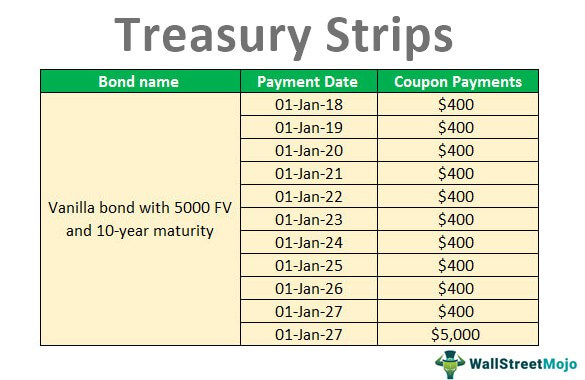

corporatefinanceinstitute.com › bondsBonds - Overview, Examples of Government and Corporate Bonds Feb 04, 2022 · The U.S. government’s debt is considered risk-free for this reason. 2. Treasury bills. Maturity < 1 year; 3. Treasury notes. Maturity between 1-10 years; 4. Treasury bonds. Maturity > 10 years; 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local ... United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield ... United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield Curve - Yield, end of period - US dollar, provided by Reuters (Financial market data) Period ↓: value: obs. status: 2022-Q1: 2.4437: Normal value (A) 2021-Q4 : 2021-Q3: 1.5345: Normal value (A) 2021-Q2: 1.4701: Normal value (A) 2021-Q1: 1.8297: Normal value (A) 2020-Q4: 0.9385: Normal value (A) 2020-Q3: 0.7179 Zero Coupons and STRIPS - Federal Reserve Bank of New York Zero Coupons and STRIPS - FEDERAL RESERVE BANK of NEW YORK. Home > About the New York Fed >. Zero Coupons and STRIPS. This content is no longer available. Please see TreasuryDirect - STRIPS for current information on this subject. You will be automatically forwarded in 4 seconds, or click the link. By continuing to use our site, you agree to ... What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.501% yield. 10 Years vs 2 Years bond spread is 53.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016). The Germany credit rating is AAA, according to Standard & Poor's agency.

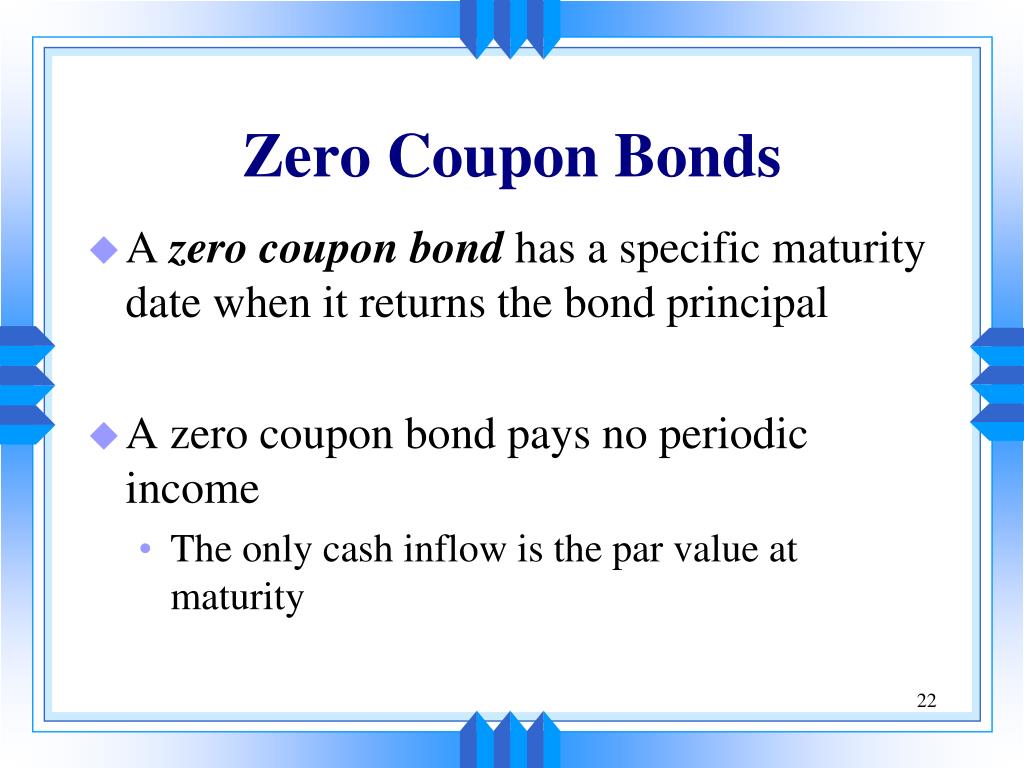

Zero-coupon bond - Wikipedia A zero coupon bond is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. When the bond reaches maturity, its investor receives its par value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

What are Zero Coupon Bonds? - Civilsdaily Zero-Coupon Bonds These are non-interest bearing, non-transferable special GOI securities that have a maturity of 10-15 years and are issued specifically to Punjab & Sind Bank.

Russian Government Bond Zero Coupon Yield Curve, Values (% per annum ... Russian Government Bond Zero Coupon Yield Curve, Values (% per annum)

Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... We price CAT bonds with a face value of €1 at time \(t=0\) years considering two types of payoff functions: zero-coupon and coupon. The coupon C is taken as €0.6.

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero Coupon Yield Curve - The Thai Bond Market Association 50.158904. Remark: 1. The above yields are based upon average bids quoted by primary dealers, after 15% data cut-off from top and bottom when ranked by value. 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3.

How to Invest in Zero-Coupon Bonds | Bonds | US News Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't...

SGS Bonds: Information for Individuals Coupon Payment: Semi-annual coupon starting from the month of issue. Paid on the first business day of the month. Transferable: Yes. SGS bonds can be traded on the secondary market - at DBS, OCBC, or UOB branches; or on SGX through securities brokers. Maturity and redemption: No early redemption, but can be sold in the secondary market. Investors receive the face (par) value at maturity (i.e. price of S$100)

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield).

Government, Zero-Coupon & Floating-Rate Bonds - Study.com Bonds are debts that investors can buy to be repaid at a designated interest rate. Explore examples of three different types of bonds commonly exchanged: Government, Municipal, zero-coupon, and ...

Domestic bonds: USA, CMB 0% 11oct2022, USD (119D) US912796YD50 Issue Information Domestic bonds USA, CMB 0% 11oct2022, USD (119D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... The U.S. government bond market is the largest, most reliable and liquid in the world. ... Zero-coupon bonds CMB ...

Government - Continued Treasury Zero Coupon Spot Rates* 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero Coupon) Rates" on ...

› country › united-kingdomUnited Kingdom Government Bonds - Yields Curve Jun 11, 2022 · The United Kingdom 10Y Government Bond has a 2.547% yield.. 10 Years vs 2 Years bond spread is 43.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022).

Post a Comment for "41 government zero coupon bonds"